THE TWO-POT SYSTEM

Current withdrawal period – from 1 March 2025

- If you have already made a withdrawal from your savings pot, or if you have never made a withdrawal, from 1 March 2025, you will have an opportunity to withdraw again.

- You can only withdraw from your savings pot once per tax year. The tax year runs from 1 March to 28 February of the following year.

- You will need to have more than R2 000 in your savings pot.

You must submit your two-pot savings claim through AF Connect.

You can login or register here.- If you really need to withdraw from your savings pot, speak to an accredited financial adviser who can then help you make the best decisions. Contact the Alexforbes Advice Centre on 0860 100 444 or email iac@aforbes.com.

The two-pot system started on 1 September 2024.

The two-pot system is needed because many members are struggling financially and are not saving enough for retirement. In the past, members would change jobs in order to withdraw from their retirement savings.

HOW DOES IT WORK?

One-third of your retirement contributions go into your Savings Pot.

Two-thirds of your retirement contributions go into your Retirement Pot.

Your Savings Pot

- On 1 September 2024, 10% of your retirement savings or R30 000, whichever was smaller, was moved to your savings pot.

- The balance of your retirement savings, was moved to your vested pot.

- The two-pot system allows you to withdraw some cash from your savings pot without leaving your job or retiring.

Your Retirement Pot

- The savings in your retirement pot are preserved for your retirement.

- You are not allowed to withdraw from your retirement pot, even if you change jobs.

- When you retire, you must use your total savings in your retirement pot to purchase a retirement annuity. This annuity is used to provide you with a steady income during your retirement.

- The more you have saved in your retirement pot, the more money you will have monthly when you retire.

- You may transfer from your savings pot into your retirement pot, but you may not transfer out of your retirement pot.

What is Your Vested Pot?

- On 1 September 2024, your retirement savings that were not moved to your savings pot, were allocated to your vested pot.

- No contributions are made to your vested pot. This money is left to earn investment returns.

- You cannot make withdrawals from your vested pot until you exit the Fund.

- transfer your vested pot to your new employer,

- transfer your vested pot to another approved fund,

- withdraw some of your savings, or

- withdraw all of your savings.

MAKING WITHDRAWALS

- You can make a withdrawal from your savings pot once per tax year.

- To make a withdrawal you must have at least R2 000 in your savings pot.

- In order to make a withdrawal from your savings pot, you must register on AF Connect.

Click here to login or to register on AF Connect.

Register on AF connect to make withdrawals from your savings pot, track your claims, access your benefit statement, update your beneficiaries, and much more.

- This allows you to apply to withdraw money from your savings pot.

- Check your investment balances.

- Update your beneficiaries.

The Disadvantages of Withdrawing Cash

- Withdrawing from your savings pot reduces the amount of money you and your family will have to live off once you retire.

- You may not have enough cash to meet your needs when you retire. When they retire, most members need cash to pay off debts, pay medical bills, etc.

- It is best to keep all your retirement savings invested for your retirement.

- This will also earn you compound interest on your savings. This is when your interest earns interest, making your money grow.

- If you really need to withdraw from your savings pot, speak to an accredited financial adviser who can then help you make the best decisions. Contact the Alexforbes Advice Centre on 0860 100 444 or email iac@aforbes.com.

What About Tax?

- If you make a withdrawal from your savings pot before retirement, the cash will be included in your gross income for the tax year. In other words, you will be taxed on the money you withdraw.

- You will pay tax at a higher tax rate (SARS calls this your marginal tax rate) on any amounts you withdraw from your savings pot before you retire.

- If you wait until you retire to withdraw from your savings pot, you may withdraw up to R550 000 tax free. This is a big saving in tax, which means more money for you.

Save Separately for Emergencies

Two-pot System Fast Facts

- What is the two-pot system and how does it work?

- What happened to my retirement savings from before the two pot system?

- Where can I find more information?

- How do I contact Alexforbes via WhatsApp?

- What are my available withdrawal limits?

- How much is in my retirement pot?

- Is there money in my savings pot?

- Find answers to your questions.

- More about the My Money Matters Toolkit.

- How to reach Alexforbes on WhatsApp.

- The Alexforbes call centre contact details.

- What does my vested pot consist of?

- How is my vested pot managed?”

- What happens to my vested pot if I change employers?

- When I retire, what happens to my vested pot?

- Withdrawing cash from your savings pot.

- What are the tax implications and processing fees for withdrawals?

- How to register and login to AF Connect.

- A withdrawal checklist for your savings pot.

- What are the steps to submitting a savings pot claim.

- Common issues that may delay or prevent your savings pot claim.

- What are your options when you leave your employer?

- Which pots are accessible when you leave your employer?

- Preserve your savings pot for your future.

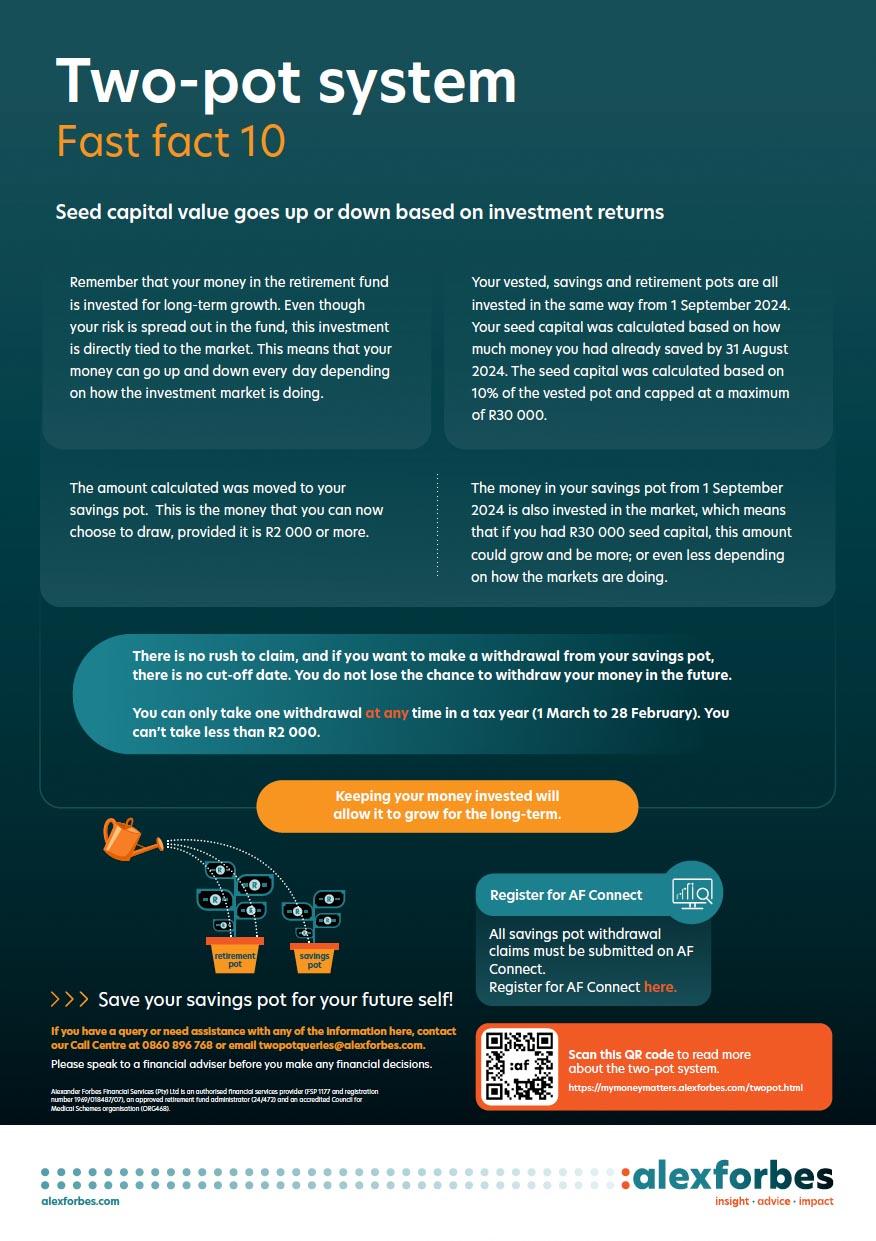

- The value of your retirement savings rises and falls with investment performance.

- How are your different pots invested?

- Keep your retirement savings invested for long-term growth.

Frequently Asked Questions

SA National Treasury FAQs

Alexforbes WhatsApp service

Using our WhatsApp service not only registers you to AF Connect and grants you access to two-pot information, but you also get to access other financial services.

With Alexforbes WhatsApp you can:

- Request your most recent tax certificate, benefit statement and fund balance.

- Track the status of a claim.

- Register on AF Connect or reset your password.

- Access financial education.